If you aren’t using CTV in your media mix, you’re likely missing the audience

There is no doubt that 2020 was the year of streaming and changed the television landscape forever. We saw Connected TV (streaming television options such as Hulu, YouTubeTV and Peacock) avails double overnight in mid-March and it didn’t slow at all throughout the year. BCH has purchased “airtime” on CTV programmatically since 2017, and the evolution in this space is mind-blowing.

Americans are spending more time with video than ever before, but you have to adapt to the fragmented landscape or you will sacrifice the reach of your message. Keep these trends in mind with your 2021 paid media strategy:

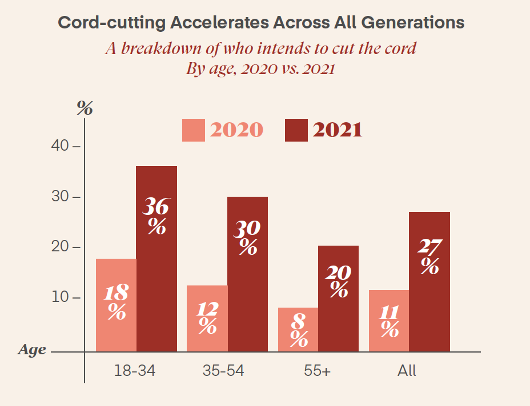

Cord-cutting Hits (Another) All-Time High

According to The Trade Desk, 27% of cable subscribers intend to cut the cord in 2021, up from 15% in 2020… a year that already saw the largest-ever increase in cord-cutting.

To put that in perspective, according to eMarketer, fewer than 78 million U.S. households maintained a cable subscription at the start of 2021. At the same time, advertisers could reach more than 84 million households via connected, streaming TV services for the first time.

Many of these households are moving to virtual cable providers like SlingTV, YouTube TV, AT&T Now, and Hulu+, also known as vMVPDs, which allows advertisers to buy “cable” inventory focused on their target audience.

It’s important to mention that this cord-cutting is no longer indicative of a younger generation. We’ve tracked this trend for the past five years, and every year it becomes more consistent across demographics, as illustrated in the chart below. So, regardless of your target audience, CTV should be on your radar.

Free Streaming Services on the Rise

“Outside of sports, all signs point to us living in a streaming world. This does face an upper limit, however: Households will not be able to afford to subscribe to it all — which is actually a great thing for advertisers. Free ad-supported TV (FAST) will be a major factor in streaming’s future.”

David Cohen, CEO, IAB

Just when we didn’t think the CTV space would have yet another acronym, we now have FAST and it’s critically important to a CTV campaign. There isn’t a clear leader in the “freemium” space with services like PlutoTV, TubiTV, Peacock, and Crackle all in the horse race. It is notable that Peacock is new on the scene, with an aptly timed release in April 2020, so it’s no surprise that the platform is exceeding initial projections. Amazon has IMDb TV, and our team is keeping an eye out for how these freemium providers will continue to monetize their inventory in 2021.

We’ve Hit a Tipping Point for TV Buying

This may seem like a bit of an exaggeration, but as discussed at the CES Variety Entertainment Summit on January 14, this is unanimous among tech companies, National advertisers, and TV networks alike.

“2020 will be seen as a ‘moment in time’ for ad buying, the way we buy TV is forever changed – there is no turning back, only racing forward.”

Mike Law, President of Dentsu’s Amplifi

We’ve been a huge proponent of the CTV space since 2017 as one of the first agencies to utilize the platform on the local level. At the time when we had limited inventory to choose from. So much has changed, but this matters to every advertiser because increased usage means your CTV buy doesn’t resemble a TV or Cable buy… CTV buys provide the TV experience to your target audience with an ability to track online and offline behavior.

2021 is the time when the status quo is not good enough. It’s critical to reassess the entire plan and gain an understanding of how every tactic works together. Linear television is still important, but you can no longer ignore the power of CTV and its place in the media mix. And you shouldn’t ever have to wonder “which part of the advertising spend is wasted?”

Previous Post

Previous Post